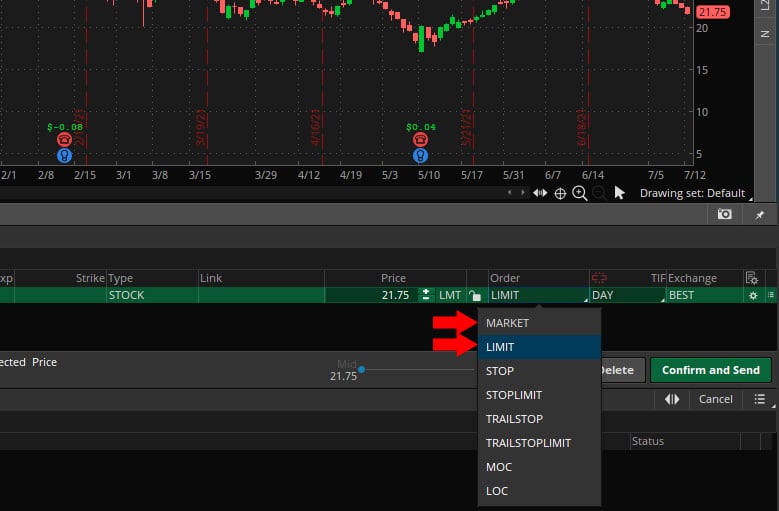

You may be curious to know the difference between a Market Order and Limit Order.

In your broker account, when you buy a stock, you have several buying options. The two most popular options are Market Order and Limit Order.

Here is the difference.

Market Order: A Market Order allows you to buy the stock immediately at the price shown. For example, let’s say a stock is trading at $24.50 and you select Market Order. When you buy the stock, you will buy it at the exact price it’s trading at that very moment. In this example, you will buy the stock for $24.50. This is the most common way to buy stocks. Now keep in mind, some broker platforms don’t show real-time data. Fortunately, TD Ameritrade does but other platforms may have a 15-minute delay or more. When you buy at the market order, and there is a delay with your broker, you will buy at the actual share price of the stock, not the price shown in your broker. This means you will buy the stock for a slightly higher or lower price than what is displayed in your broker. This is completely okay and the variance may only be a few cents.

Limit Order: A Limit Order is a little more complex. With a limit order, you can set the upper limit in which you want to buy a stock. For example, let’s say a stock is trading at $56.75 and you want to buy the stock at $56.50. When you buy the stock at a limit order of $56.50, the order will enter into a queue and wait for the shares to drop down to $56.50. This means the shares will only be purchased at $56.50. Also, when selecting a limit order, you will also need to select a duration. If you select “day” this means the limit order duration is the current day. So if we refer back to the $56.50 example, if you set a limit order to the same day, and the share price never drops to $56.50 the same day, the order will not be completed. In other words, you didn’t buy the shares. You can simply repeat the process the next day or proceed with a market order the next time around.