At this moment, you probably fall in one of two buckets.

Bucket 1: You’re a saver

Bucket 2: You’re an investor

I know these are two simplified perspectives of each so let’s dive in a little deeper.

Bucket 1: The Saver

Saving money is good. It’s the discipline of spending less than you earn to put away for a future date. Maybe you’re saving for retirement or a major purchase like a home. Or maybe you’re saving to feel some sort of security in your life. Either way, you’re putting money away which is good.

Bucket 2: The Investor

We’re all taught from a young age to work for money but unfortunately, our education system and our society doesn’t teach us to flip the equation so money works for you. If you’re an investor, you already know that leveraging compound interest in your favor is a beautiful thing.

Now let’s circle back to the title of the article. The reason why savings is making you poor is because of one word, inflation.

Every year inflation increases but the value of money does not. We’ll break this down so you can understand how this is possible.

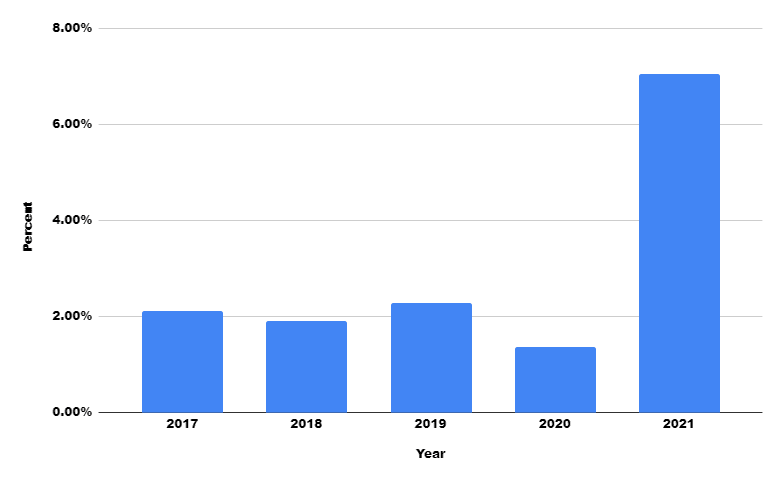

On average, inflation increases by 2% – 3% per year. Here are the inflation rates over the last 5 years in the US. By comparison, most countries are very similar.

- 2017 = 2.11%

- 2018 = 1.91%

- 2019 = 2.29%

- 2020 = 1.36%

- 2021 = 7.04%

So how does inflation affect you?

The products and services you pay for, usually increase every year to keep up with inflation. To keep up with inflation, your income and savings and/or investing needs to also increase. If they are not, the value of your money is decreasing.

Let’s take a closer look at your income

Let’s say your salary in the US was $50K/year in 2021. The inflation rate in 2021 was 7.04% which means you should be making $53,500 in 2022. In other words, you should have received a 7% raise without asking. If you are making less than $53,500 in 2022, that means you are actually getting paid less. Unfortunately most employees won’t negotiate for an inflation rate match and believe me, the executives are counting on this. So in this case employees go on with the attitude, “I guess I’m happy to just have a job.”

Now if you want to keep up with inflation, you have two options.

- Present the inflation rate to your employer and ask for a raise. Of course, you want to also present the net profits and reduced costs you provided to the company to give yourself a little more ammunition in the conversation. Trust me, don’t just show up to that meeting asking for an inflation rate match, you probably won’t get it.

- Polish your resume and apply for another job. In this case, ask for a pay increase over 7.04%. This option can be hard for a lot of people because it requires you to learn a new culture, new processes, and build trust with new employees. If you’re comfortable jumping from one job or company to the next, this may be your best option.

Now let’s take a closer look at your savings.

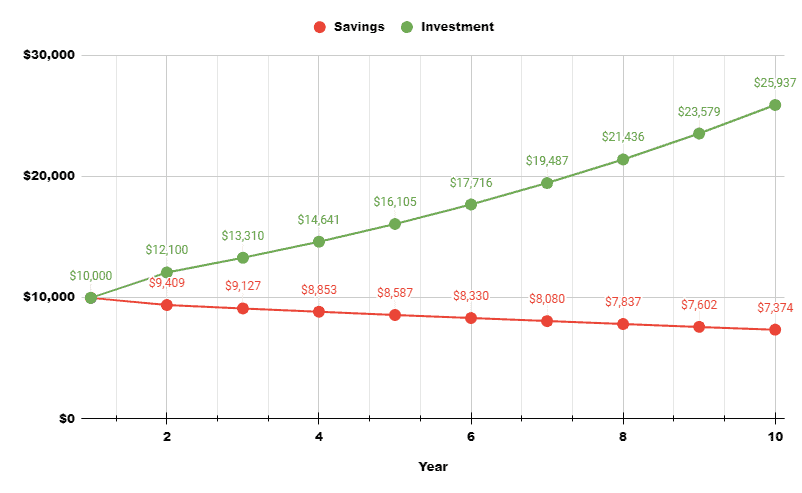

The average savings account earns about .06%. By comparison, the S&P 500 Stock Market Index has generated an average of 13% over the last 10 years. For the investing examples below, we’ll apply an even 13%.

Key

- Savings = .06% annual return

- Investing = 13% annual return

Here is why your savings account is making you poor.

$10,000 with 3% inflation.

- In 10 years with savings, $10,000 will be equal to $7,374.

- In 10 years with investing, $10,000 will be equal to $25,937.

As you can see, inflation erodes your savings. Inflation also erodes into your investment account but as you can see, investing in the stock market still puts you way ahead of the curve.

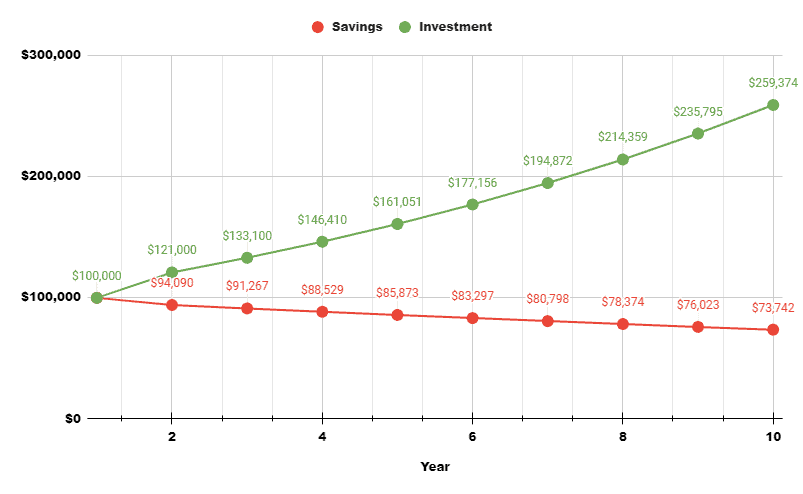

$100,000 with 3% inflation.

- In 10 years with savings, $100,000 will be equal to $73,742.

- In 10 years with investing, $100,000 will be equal to $259,374.

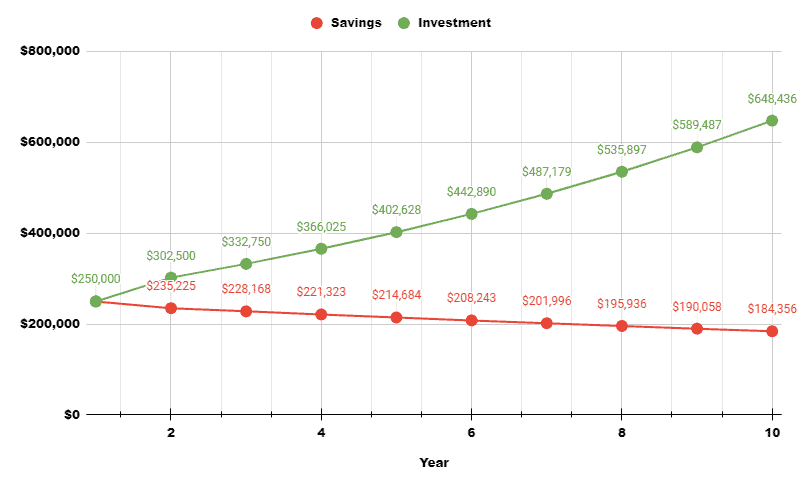

$250,000 with 3% inflation.

- In 10 years with savings, $250,000 will be equal to $184,356.

- In 10 years with investing, $250,000 will be equal to $648,436.

The more you put away in savings, the less value your savings becomes. Inflation is not our friend.

Now you may be curious about investing. Today, a lot of people around the world are setting up a broker and investing in the stock market. Most brokers today are free to sign up and free to place trades. The barrier to entry is easier than ever.

The challenge most investors face is they don’t know where to start. Most investors hear about popular stocks such as Apple (AAPL), Tesla (TSLA), Microsoft (MSFT), Gamestop (GME) and Netflix (NFLX) but which stocks are good investments and which stocks should we avoid?

That’s where Tykr can help.

Tykr is a platform that helps you manage your own investment. It’s especially easy for beginners because it guides you to safe investments and steers you away from risky investments. On top of finding good companies to invest in, it teaches you how to invest along the way.

At this point you have two options…

Option A: You can keep saving your money, which will decrease in value.

Option B: You can start investing and let money work for you.

If you’re interested in investing, we welcome you to join Tyke for free. Click here.