Clear Confident Investing

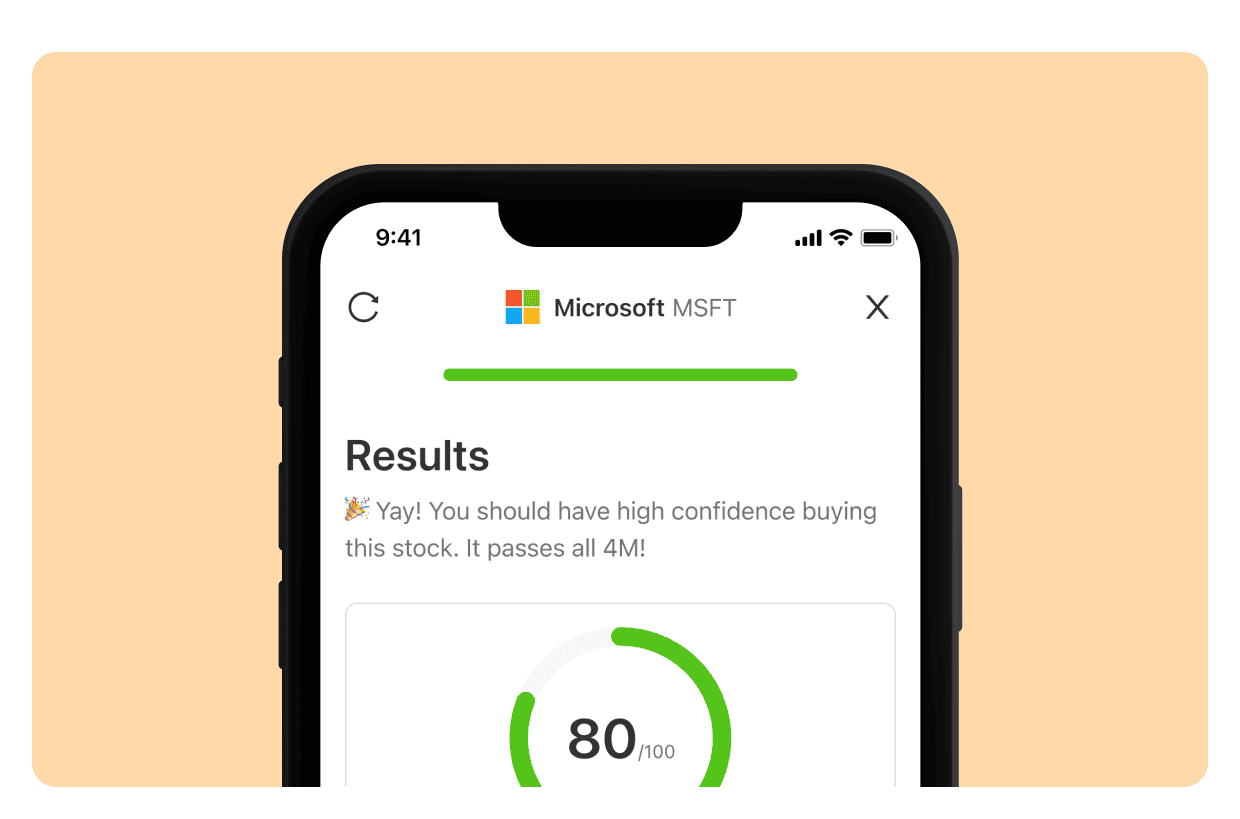

Simplified analytics and education to help you go from a beginner to confident investor in 14 days or less.

14-day free trial. 30-Day Money-Back Guarantee.

Feature Highlights

3 Easy Steps

STEP 1

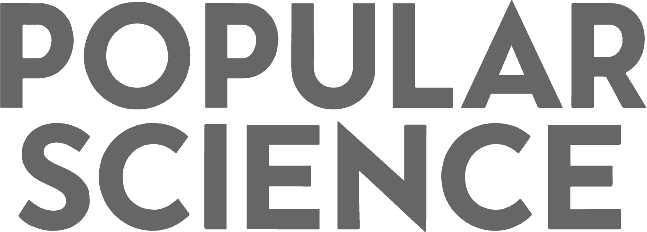

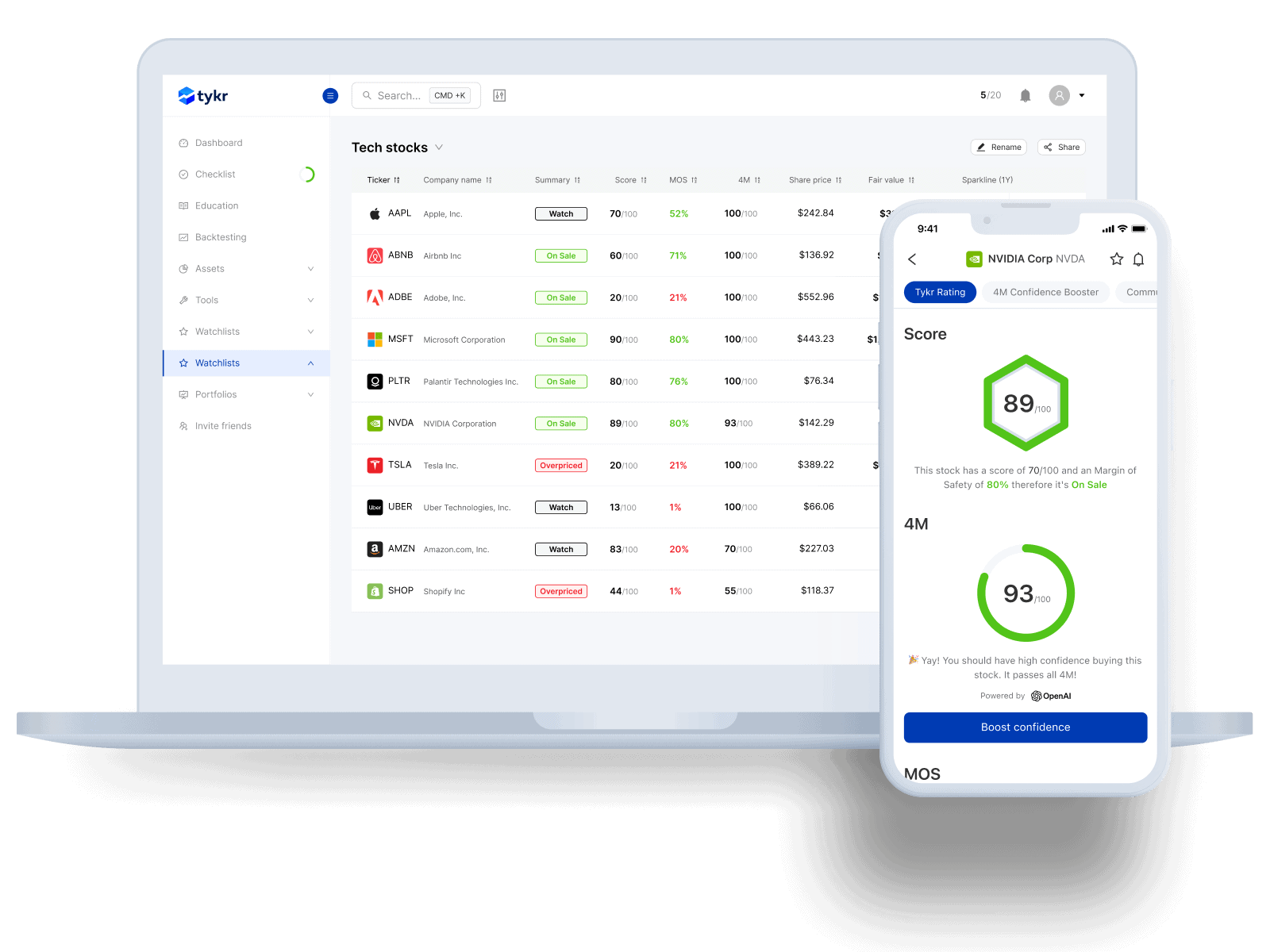

Join the Web app or Mobile app

Join the web app or mobile app (iOS and Android) for free.

STEP 2

Complete your Checklist

90% of Tykr customers who complete their checklist are able to buy and sell stocks with confidence within 14 days or less.

STEP 3

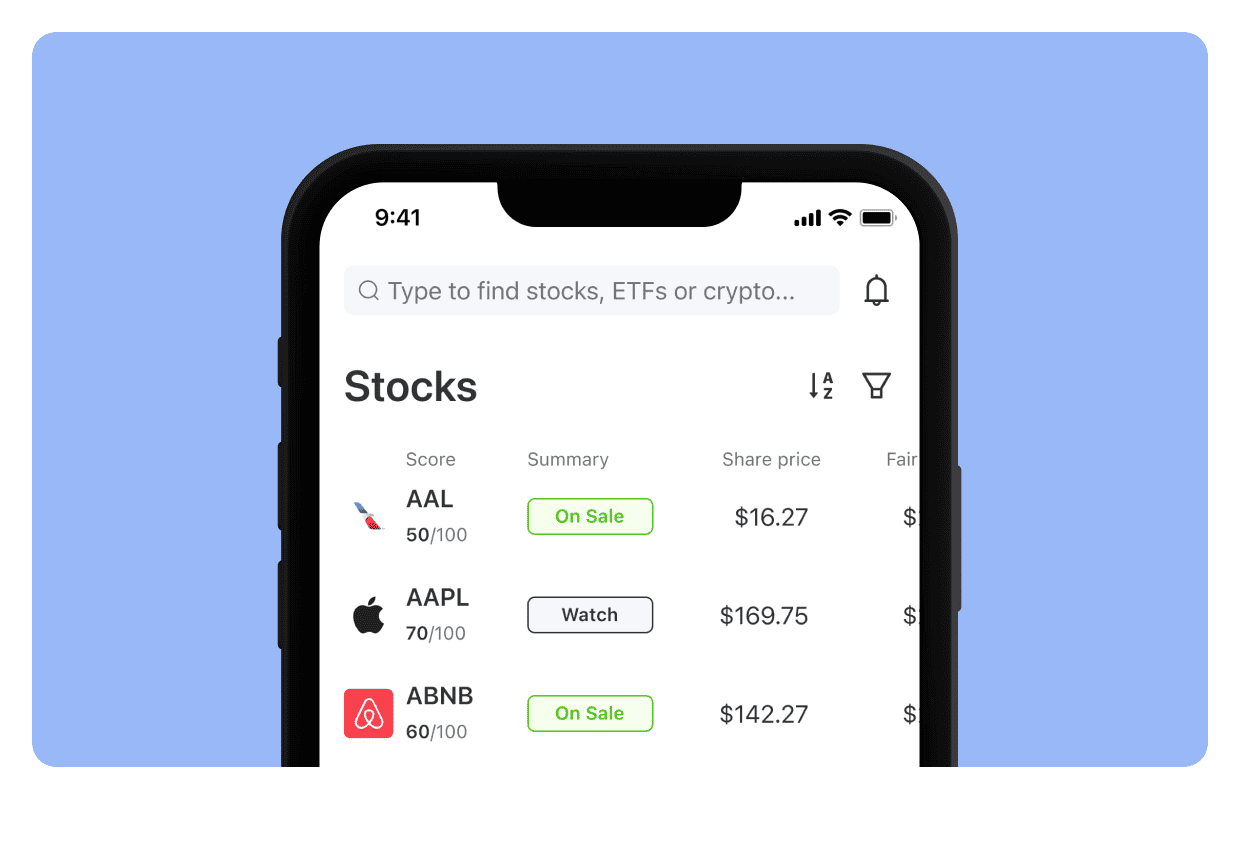

Buy and Sell Stocks with Confidence

Within 14 days or less, you should know what stocks to look for, what stocks to avoid, and how to reduce the risk of losing money in the stock market.

Reviews

Since 2020, Tykr has helped thousands of investors make better investment decisions.

Disclaimer: Testimonials do not guarantee future results.

Featured In